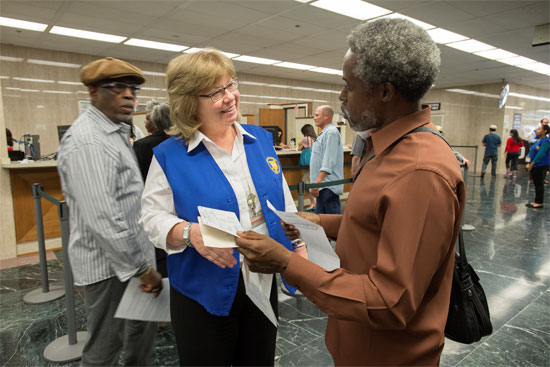

With deadline fast approaching, Kathy Gloster helps a property owner pay his tax bill.

By the time zero hour arrived Thursday, the logistics had been locked down for weeks.

Blue vests were freshly dry-cleaned, clipboards loaded up with sample forms and cheat sheets, schedules ironed out with minute-by-minute precision.

All that was missing were the taxpayers. But soon, they showed up as well, completing a biannual ritual that, for the last three years, has sent Kathy Gloster and her team into first floor lobby of the Los Angeles County Hall of Administration to bring order and a touch of TLC to nobody’s favorite task:

Paying property taxes.

“Sometimes there are so many people in the lobby that we have to do crowd control,” said Gloster, a 10-year veteran with the county Treasurer and Tax Collector.

While the crowds were smaller than usual on this year’s April 10 deadline—Gloster hopes and assumes that’s because more people are paying online—the blue vest team was out in force, helping to keep things moving as lines swelled to up to 10 people deep.

Gloster, an assistant treasurer-tax collector, is charged with organizing the collection of the nearly 2.4 million tax bills issued by the county each year. A month ago, she started meeting with her staff to create a schedule for tax supervisors and managers to put in 90-minute shifts in the lobby. Their job is getting taxpayers to the right lines and making sure they have all their paperwork in order. Since property taxes come in two installments—one due on December 10, the other on April 10—the blue vest brigade hits the lobby twice a year to meet a (mostly) accepting public.

“You have people who are really excited because they are paying their first bill on the first property they’ve ever bought,” Gloster said. But others, she said tactfully, “are just maybe not as happy with you as you would like them to be.”

The vast majority of property owners pay by mail, online or by other arrangements, but about 2% come in person—no doubt more aware than anybody of the steep 10% penalty in store for those who pay late.

People love to hate the tax man, but the soft-spoken Gloster insists that she and her team can win most folks over by extending a helping hand.

“When you tell someone you work in the tax collector’s office they say, ‘Oh, you do terrible things,’ ” Gloster said. “But when we get to help somebody, it’s a lot of fun. We can explain things to them.”

Many people come without their bills or, worse, are unable to pay the full amount. “They get that look in their eye that they can’t pay their taxes, and that’s kind of sad.” But the unhappiest taxpayers of all may be those who accidentally show up on income tax day—April 15. At that point, there’s nothing she can do, and the extra 10% is added to the bill. Gloster said she has seen penalties as high as $250,000 for a single parcel.

But most people just want to make their payment and get out of there as quickly as possible, and many offer thanks for the speedy help they receive.

One worker, Ingrid Fontenot, said she enjoys the whole routine.

“It’s a little tiring standing on your feet for an hour and a half, but it’s very fulfilling,” she said. ”I’ve gotten a lot of compliments about our process and how organized we are. It’s a good feeling.”

Meanwhile, the department gets bombarded by phone calls from people with questions about their bills or how to pay online or by mail. Gloster said her department fields about 23,000 calls in the month of April alone.

Gloster also has a cautionary tale for those who pay by mail. If a payment is postmarked by the deadline, it is considered “on time.” However, in this day of QR codes and alternative kinds of stamps, some envelopes don’t get postmarked. Paying online is the best way to make sure the payment is on time, Gloster said, but if you’re mailing it in, it’s a good idea to send it a few days early, just to be safe.

Posted 4/11/14