We’re back in the black

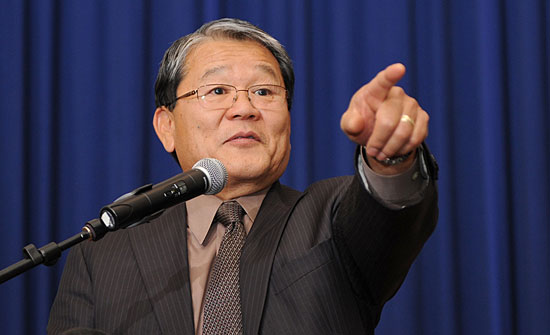

L.A. County CEO William T Fujioka says rising revenues have lifted the budget outlook.

While expressing concerns about the endurance of the rebounding economy, Los Angeles County’s chief executive has unveiled a proposed budget that confronts some of the county’s biggest challenges and controversies, funding more than 1,300 new jobs to tackle everything from healthcare reform to child protection to oversight of deputies in the jails and on the streets.

Chief Executive Officer William T Fujioka told the Board of Supervisors on Tuesday that his proposed $26 billion spending plan for fiscal year 2014-2015 represents a cautious expansion of county spending that had been cut by an average of 15% during the Great Recession, beginning in 2008-2009. Fujioka said the driving philosophy behind his proposed budget—balanced for a second consecutive year—is “stabilization” and “sustainability” as county revenues continue to rise with the recovery. (Complete budget details can be seen here.)

Just four years ago, the county had its largest budget gap of the recession—$491 million—and was forced to tap reserves to avoid layoffs and deeper service cutbacks. For five years, employee labor unions agreed to zero salary increases to help the county survive the economic crisis. Now, in the proposed budget, $217 million in “unavoidable cost increases” has been earmarked for raises, benefits and retirement costs negotiated with unions as property and sales tax receipts have moved the county out of the red.

In his budget briefings to the board and the media, Fujioka has emphasized that uncertainties at the federal and state levels could substantially change the county’s budget outlook. Only about $6 billion of the county’s $26 billion budget comes from locally generated revenue, such as property tax, which is forecasted to increase by a little more than 4%. The rest comes from state and federal governments.

If approved in June by the board after public hearings and deliberations, the CEO’s proposed budget would not only reverse some cuts made in recent years (county library hours, for example, would be restored to 2009-2010 levels), but also would underwrite reforms in two departments rocked by controversies.

The budget proposes adding 100 new social worker positions and 26 support staff jobs to the Department of Children and Family Services to reduce caseloads and better protect youngsters who come in contact with the county’s child welfare system.

The move to beef up the social worker ranks through a variety of government funding sources gained momentum after several high-profile deaths of abused children galvanized support for broad reforms. According to Fujioka, additional funds also will likely be made available to underwrite recommendations of the Blue Ribbon Commission on Child Protection, which was created by the Board of Supervisors and is now completing its work.

Fujioka’s budget also calls for spending $36.5 million to implement reforms recommended by another board-created panel—the Citizen’s Commission on Jail Violence, which examined allegations of widespread brutality by Los Angeles County sheriff’s deputies inside the county lockup. This funding, along with $20 million in ongoing resources provided during fiscal year 2013-2014, would pay for more supervisors and more rigorous internal oversight, among other things.

What’s more, funding will be made available for more than two dozen positions in the newly created Inspector General’s Office, a key commission recommendation aimed at bringing more oversight and accountability to the Sheriff’s Department.

Not all the new jobs in the budget, however, are being proposed as a response to scandals. Some are meant to be proactive, “providing a strong foundation as we move forward,” Fujioka said.

More than 700 full-time nursing positions are being proposed to help the Department of Health Services meet state-mandated nurse staffing ratios and compete for low-income patients who, under the federal Affordable Care Act, will receive subsidized health insurance. These patients now will be able to seek care elsewhere. And that means a potential loss of revenue to the county. Thus, Health Services is determined to transform the county from a provider of last resort into a provider of first choice.

Fujioka credited the sound fiscal policies of the Board of Supervisors with allowing county government to ride the economic downturn of recent years with a minimum of disruption, unlike other local governments in Southern California and across the nation.

Said Fujioka: “The board’s long-standing conservative budget practices, and our strong compliance to fiscal policies, enabled us to weather these trying economic times.”

Posted 4/17/14