Consumer Help

Some help taking out the trash

October 25, 2011

No matter how much we reduce, reuse and recycle, sometimes the dumpster is our only choice.

Most garbage can be tossed out normally, but hazardous materials require special treatment, and bulky items like furniture usually are collected by appointment. Los Angeles County Department of Public Works (DPW) offers assistance, but hazardous materials still end up in landfills.

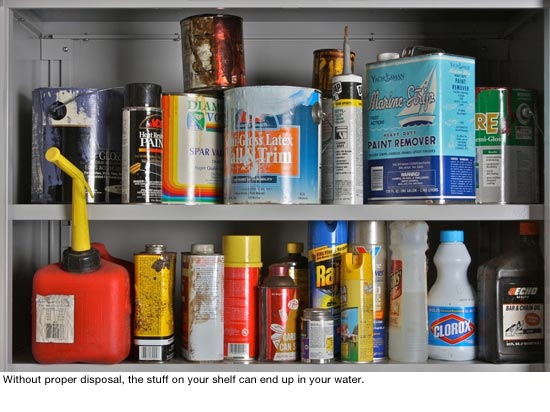

“The number one reason people dispose of hazardous waste improperly is because they don’t know they are hazardous.” said Natalie Jimenez, Household Hazardous Waste program manager. “The main thing we want people to do is look at the label.”

According to the department website, “any product labeled toxic, poison, corrosive, flammable, combustible or irritant” is hazardous. There’s also electronic waste, or “e-waste,” which includes everything from computers to hair dryers, and “Universal wastes,” like batteries and fluorescent tubes, which contain corrosive chemicals and mercury. Home medical wastes including “sharps” and unused or expired medication are also considered hazardous.

These wastes cause serious problems when tossed in the trash or poured down drains. They injure sanitation workers, contaminate groundwater and disrupt biological processes used to treat wastewater before it goes to the ocean.

Of course, the hazardous materials themselves also end up in oceans and waterways, contributing to unsafe beaches and polluted ecosystems. Fines for improper disposal can be as high as $10,000.

If you need to dispose of hazardous wastes, use permanent disposal facilities in Los Angeles City or take advantage of the mobile collection events organized by the county. Public Works recommends listing unwanted but working electronic items on the Los Angeles County Materials Exchange, and the Los Angeles County Sheriff offers convenient drop-off locations for sharps and expired medication.

Of course, the best way to ease impacts of hazardous waste is to reduce how much of it you discard. Click here to learn how.

Large household items—furniture, fridges and other appliances—are not accepted by hazardous waste collections and must be disposed as “bulky items” by contacting your local trash collection agency. To find out who that is, use this online tool.

On Saturday, November 5, unincorporated parts of the San Fernando Valley can get rid of bulky items for free—no appointment needed. Sunshine Valley Landfill is hosting a Free Disposal Day from 8 a.m. to 1 p.m. Residents can drop off up to a ton of household refuse free of charge. Accepted items include furniture, appliances and mud debris. The landfill will not accept business waste or hazardous waste.

To take advantage of the opportunity, residents must bring proof of residency (a driver’s license, for instance) or a copy of the flyer that was mailed recently throughout the area. To determine whether your home is in the eligible service area, see page 2 of the flyer. Supervisors Zev Yaroslavsky and Michael Antonovich are sponsoring the event.

As always, before trashing items, see if someone else can use them. Charitable organizations and thrift stores take large items on a donation basis. Your trash could be someone else’s treasure, and you’ll lessen the load on landfills in the process.

Posted 10/25/11

Missing a $26,234 tax refund?

October 13, 2011

Los Angeles County is $2.32 million richer this week, thanks to more than 6,000 unclaimed property tax refunds that have nowhere to go but the county’s general fund.

Los Angeles County is $2.32 million richer this week, thanks to more than 6,000 unclaimed property tax refunds that have nowhere to go but the county’s general fund.

State law authorizes counties to keep excess tax payments if no one claims them for four years. So every year about this time—as tax bills go out to millions of Southern Californians—the Treasurer and Tax Collector’s Office reluctantly deposits another pile of money from over-payers who couldn’t be located.

This year’s unclaimed refunds, from 2005-06, were only a tiny fraction of the more than $11 billion collected in the county that tax year. Many were for modest amounts ($1.59 was the smallest), but someone out there also failed to claim a refund worth $26,234.

Los Angeles County Assistant Treasurer and Tax Collector Nai-len W. Ishikawa says the county tries hard to track down recipients of refunds, and gets better at it every year; unclaimed overpayments have steadily declined for the past three years, even though collections rose during the tax periods involved.

But sometimes, the trail just goes cold, she says.

“Sometimes the property owner has passed away,” says Ishikawa. “Sometimes there’s been a change in ownership and we don’t have the person’s address.”

Typically, she says, overpayments occur when a tax bill has been inadvertently double-paid by spouses or a mortgage company and the county lacks sufficient information to generate an automatic refund. This, she added, can happen when the overpayment has been made via cash, a money order or an unaddressed check.

In other cases, the county gets a payment, but can’t apply it because the taxpayer forgot to include the bill stub or to write the parcel number on the check or wrote an invalid number, she says.

Although the vast majority of unclaimed refunds this year—about 5,500 items totaling about $1.43 million—were for overpayments, checks with missing parcel numbers or bill stubs hardly amounted to pocket change. In all, there were 942 of them, totaling about $880,000. The largest was $17,412.

Ishikawa says the county cannot issue a refund without documentation of an overpayment. But, she added, taxpayers can claim their money even after the 4-year deadline if the documentation shows that the county has made a mistake.

Donna Doss, the assistant treasurer and tax collector whose staff processes payments, says unclaimed refunds automatically go into a special file. Staffers in her office then begin the arduous process of finding and notifying the recipient before the 4-year deadline.

“We check our records to see if they own additional property in the county,” Doss says. “We look for any address on file within the county and send letters. We contact the title company.”

About 99% of the overpayments are cleared up, she says: “Often, we are able to locate people and they’re happy to receive their refund.”

But, she adds, staff is limited and searches can’t last forever. Each year, the county generates and processes about 2.3 million property tax bills. Less than one-hundredth of one percent of payments end up with unclaimed refunds.

“Our main mission is to collect taxes, after all,” Doss says. “At some point, you hit diminishing returns.”

Posted 10/13/11

A helping hand with the phone

July 28, 2011

For folks who have trouble using a standard telephone, help is available–and it’s free. The California Telephone Access Program provides specialized telephone equipment to residents who have difficulty hearing, seeing, moving, speaking or remembering.

When the program was established in 1979, it only provided Teletypewriter machines for the deaf. It has since evolved, and now serves more than 500,000 people with a broad range of disabilities. It provides more than 60 kinds of equipment, including Braille devices, hands-free phones, phones with oversized numbers and phones that amplify outgoing or incoming speech. What’s more, a companion program, the California Relay Service helps deaf and speech-disabled callers by reading teletype aloud and putting speech into readable text.

The services are part of the Deaf and Disabled Telecommunications Program (DDTP), which is administered by the California Public Utilities Commission, mandated by the state legislature, and paid for by a 0.5% surcharge on all telephone bills.

According to program officials, one in three people will have some degree of hearing loss by age 60. More than 3 million Californians now have disabilities that make using a normal telephone difficult or impossible. With the first round of baby boomers turning 65 this year, even more people stand to benefit from the service.

They won’t have to jump through a lot of hoops to sign up, either.

“It’s very simple,” said Elena Heredia, field operations supervisor for DDTP. “A lot of people, when they learn about a government program, think ‘Oh, there has got to be a long list of info I have to provide.’ This is just one form.”

To qualify for assistance you must be a California resident, have phone service (cell phones count) and have a doctor certify the disability or impediment. The program is available regardless of age or income, and there is no need to re-register once you have been accepted. Application forms are available via DDTP’s website or by calling (800) 806-1191. If using a teletype device, call (800) 889-3974.

7/28/11

Job scams work when you don’t

June 23, 2011

Navigating the job market can be frustrating in these difficult economic times. But unemployment can go from bad to worse when job hunters become the target of scammers on Craigslist and other classified advertising sites.

Con artists exploit the desperation of the jobless by tricking them into divulging personal and financial information, says LA County Department of Consumer Affairs’ Acting Director Rigo Reyes. They then use that information to defraud the victim.

“This is always a problem when the economy slows down,” Reyes says. “We have seen a significant increase over the last year or so, not just in numbers, but in the complexity of the scams that they try to get you with.”

You can identify fraudulent job offers by arming yourself with information. According to Reyes, the two most important things to watch for are guarantees of employment and companies or individuals asking for payment up front.

Reports from the Federal Trade Commission and Privacy Rights Clearinghouse list other red flags and suggest some precautions:

Red Flags

- Requests for financial information (account numbers, credit card numbers, etc.)

- Requests for a Social Security number

- Requests to scan your ID card, or for a scan of your ID card

- Absence of a company name or contact information

- A contact email address that is not a primary domain (for example, when the hiring company is “Omegacorp” @yahoo.com instead of @omegacorp.com)

- Misspellings and grammatical errors

- Promises to get you a job

- Employment services that charge an up-front fee

- Reluctance by the hiring firm to answer your questions

- Ads containing such terms as “PayPal”, “package-forwarding”, “money transfers”, “wiring funds”, “eBay” or “foreign agent agreement”

Precautions

- Make sure you understand your duties and the employer’s duties

- Take time reading contracts and avoid high-pressure sales pitches

- Follow up with the company that listed the ad

- Check with Consumer Affairs, the state Attorney General’s office, and the Better Business Bureau to see if complaints have been filed against the company

- Research the company before sending your resume or any personal information

- Target your search to the type of job you are seeking

- Do not give prospective employers your money or financial information (after all, aren’t they supposed to be paying you?)

- Be wary of companies that want you to sign up for direct deposit before you have started work

Craigslist and other classified ad sites offer their own warnings and have security measures to protect users, but scammers often find ways around them. Furthermore, the websites are not legally responsible for the listings. The people who place the ads are responsible, says Reyes, but odds are against you getting your money back. Many of the scams originate outside of the country and are difficult to track down.

While some scams are fairly blatant, others are more clever, Reyes says. Some scammers use professional looking logos and websites. And when they steal, they take small amounts that embarrassed victims usually don’t report, and that law enforcement officials are often unwilling to prosecute.

If you find yourself victimized by a scam, you can take some action. If the scammers accessed your finances, close all accounts at the bank where it took place. Register a fraud alert with all three credit bureaus—Experian, Equifax, and TransUnion—and report the fraud to Consumer Affairs. The agency investigates complaints and presents viable cases to the City Attorney and the District Attorney for prosecution. You can call Consumer Affairs officials at (800) 593-8222, e-mail them here, fill out an online complaint form, or visit their office at 500 West Temple Street, Room B-96.

Finally, Reyes warns job hunters to guard their privacy online.

“A resume is basically an outline of your life. Who knows what they are going to use that information for?” he says. “Unless you are on a very reputable site, be extremely careful with your personal info. Once it goes online it is very difficult to get it back.”

Posted 6/23/11

Your summer right to an easier flight

May 23, 2011

With summer vacation planning in full swing, the Los Angeles County Department of Consumer Affairs has some good news.

With summer vacation planning in full swing, the Los Angeles County Department of Consumer Affairs has some good news.

Beginning in August, federal authorities will be cracking down on oversold flights, baggage fees, sneaky ticket surcharges and long delays on the tarmac, thanks to new airline passenger rules.

“This is a really good change for consumers,” says Acting Director Rigo Reyes. “One of the complaints we get all the time is that when airlines bump you or lose your luggage, they compensate you too little and too late—it’s, ‘File your claim and we’ll get back to you’.”

Under new U.S. Department of Transportation passenger rights that take effect Aug. 23, passengers who are bumped from an oversold flight will be entitled to more money—up to $650 for short delays (of less than four hours), and up to $1,300 for longer ones.

Moreover, airlines will not only have to reimburse passengers for lost luggage, as is now the case, but also will have to refund those irritating extra baggage fees.

“And they will have to be very clear about extra fees beyond your fare when you book online,” says Reyes. “They won’t be able to put you in that position where you see a promotion and spend all this time setting it up, and then find all these sorts of fees you didn’t know about tacked on when you see your credit card bill.”

Also, he says, no airlines, whether foreign or domestic, will be allowed to hold passengers for endless hours on the tarmac as was the case during a December blizzard at John F. Kennedy International Airport in New York last year.

After August, four hours will be the limit, and airlines will have to give passengers status reports on the half-hour and make sure they have food, water, bathrooms and medical treatment, if needed, after two hours.

Posted 5/23/11

Protect yourself from debt protection

May 11, 2011

Life is unpredictable, the ads remind you. Don’t let your family suffer if you can’t pay your credit cards on time. Pay this “small” monthly fee and we’ll make, or even suspend, your payments if you experience a crisis.

Life is unpredictable, the ads remind you. Don’t let your family suffer if you can’t pay your credit cards on time. Pay this “small” monthly fee and we’ll make, or even suspend, your payments if you experience a crisis.

So-called “credit protection” plans are pushed relentlessly by banks, credit unions and other credit card issuers. But the Los Angeles Department of Consumer Affairs has some advice: Don’t buy.

“People think it’s really good, but they’re spending their money for, really, nothing,” says Rigo Reyes, the department’s acting director.” A recent report from the U.S. Government Accountability Office bears him out.

“Fees for these products can be substantial, with the annual cost often exceeding 10 percent of the cardholder’s average monthly balance,” according to the GAO, which is Congress’ audit and investigative arm. The credit card issuers, the report said, raked in $2.4 billion in fees for debt protection in 2009, more than half of it pure profit.

The plans are so full of exclusions and loopholes that card holders only received about 21 cents worth of actual benefits for every dollar they spent on “protection,” the GAO found. This 21% payout ratio is far lower than other types of insurance. The new health reform law, for example, mandates that payout rates for health insurance be at least 80%.

Once colloquially known as “credit insurance”, the plans are supposed to prevent penalties, fees and negative credit reports by keeping cardholders’ bills up to date should death, disability, divorce, job loss or some other emergency keeps them from paying on time.

But as state laws regarding insurance have been tightened, Reyes says, credit card issuers have changed the name to eliminate the word “insurance” and tweaked the product—now known as “debt protection”—so that it could be regulated under less stringent federal oversight.

Those federal rules are likely to tighten if and when the new federal Consumer Financial Protection Bureau comes online this summer as part of the financial reform act recently passed in Congress. But reform opponents hope to weaken the newly formed bureau and maintain the high profit margins debt protection offers to credit card issuers, at the expense of cardholders.

In the meantime, Reyes says, paying a dollar for 21 cents’ worth of coverage “isn’t a wise investment.”

“Save the money,” he suggests, “and use it to pay down the balance on your credit card.”

Posted 5/11/2011

For consumer crusaders, it’s personal

April 21, 2011

Chances are you’ve never heard of Rigoberto Reyes—unless you’ve been ripping off the public.

Reyes heads Los Angeles County’s consumer affairs department, which for three decades has been chasing scammers of all sizes and stripes—from shady car dealers, to unscrupulous real estate operators, to fake attorneys and fly-by-night wedding photographers. Each year, the widely praised department receives hundreds of thousands of calls from consumers seeking help.

But now Reyes and his department find themselves not only advocating for the public, but also making a behind-the-scenes pitch for themselves.

This week, the county’s chief executive officer, William T Fujioka, recommended that the Department of Consumer Affairs be folded into a bigger agency to reduce redundancies and increase efficiencies as part of a multi-faceted effort to eliminate a $220 million deficit in the county’s next fiscal year budget.

Fujioka has estimated that merging consumer affairs with the Department of Community and Senior Services would save $346,000 in salaries and benefits by cutting four administrative positions, on top of a $164,000 cut that would take effect even without the proposed consolidation.

Reyes says that while he appreciates the CEO’s budget strategies, his department can achieve the same savings on its own and should remain independent—“a sort of beacon for consumers with problems.”

“I’m sensitive to the needs of the CEO,” says Reyes, who, as the department’s acting director, reports to Fujioka. “It’s not us versus them. But there are different ways to get to the same place. We’ve proven over the past 30 years that we know how to protect consumers. Why change it?”

That view has found a receptive audience with the Board of Supervisors. On Tuesday, acting on a motion by Supervisor Zev Yaroslavsky, the board instructed the CEO to defer the consolidation and come up with other ways for consumer affairs to save the same amount. The board set a deadline of June, when it’s scheduled to consider the budget.

The motion, which calls consumer affairs a “high performing department,” notes that the jobs targeted for elimination are “unique” to the agency and may not be replicable by employees in the Department of Community and Senior Services. What’s more, according to the motion, a consolidation may risk the ability of consumer affairs to receive settlement funds and other external money.

Reyes says he knows exactly where the department’s lifeline can be found: in a trust account holding $5 million that the department received in 2006—the leftover proceeds of a consumer lawsuit settlement in San Diego. That payment flowed here at the recommendation of the state attorney general’s office, even though consumer affairs wasn’t involved in the case.

“We were saving the money for a rainy day,” Reyes says. “Today’s the storm.”

The money can be used only for “new or enhanced programs,” Reyes says, explaining that additional responsibilities would be given to employees whose jobs had been classified as redundant and targeted for elimination under the merger plan.

And that, he says, shouldn’t be hard, given the expanding ambitions and soaring workload of the 46-person department. For example, before the economic meltdown in 2007, Reyes says the department received 44 complaints about fraudulent foreclosures. Last year, that number soared to 545.

“When the economy slows, the need for our services goes through the roof. That’s when the scammers head out,” says Reyes, who joined the agency as a student worker in 1995.

Reyes says that at least twice before during tough financial times, plans had been drafted to merge consumer affairs with other departments—once after Proposition 13 in 1978, and again in the 1990s. But both times the Board of Supervisors determined “it didn’t make sense for consumers.”

“There are very few local departments of consumer affairs at the local level and they’re admired for what they do,” Reyes says. “They do incredible work that wouldn’t otherwise be done.”

Posted 4/21/11

Grandparents beware…

March 31, 2011

One of the best things about technology is the way it can keep families connected. But in recent weeks, consumer agencies have issued a warning:

One of the best things about technology is the way it can keep families connected. But in recent weeks, consumer agencies have issued a warning:

Grandparents beware.

A longstanding wire fraud scam has been taking a national toll on loving relatives, particularly seniors, to the point that authorities in recent week have decided to make an all-out assault on it.

“It’s become a big issue,” says Rigo Reyes, acting director of the Los Angeles County Department of Consumer Affairs. “Last year, the Federal Trade Commission got over 60,000 complaints on it.”

Here’s how it works:

A senior citizen gets an urgent call, email or Facebook message from someone claiming to be a police officer or an adolescent grandchild. The message says the grandchild has been hurt or arrested or is otherwise in trouble, and needs hundreds or thousands of dollars to be wired immediately via money order or Western Union. And one more thing: Don’t tell mom and dad.

“The grandparents don’t want anyone to be in trouble, so they wire the money without checking first with other family members,” says Reyes. “In one case, the grandmother told the caller, ‘You don’t sound like my grandson,’ and the guy said ‘I broke my nose in a car accident, so I sound different’.

“But in many cases, the crooks can fool you because they hack into Facebook accounts and get enough information about the family to drop names and birth dates and so forth. They get marketing lists with specific details, names and addresses.

“They can be convincing, but once that money is wired, it can be picked up by anyone with a password — and good luck getting it back.”

The Department of Consumer Affairs and the Consumer Federation of America offer these suggestions for seniors to avoid being scammed:

–Always check with other family members if you get an SOS from a family member.

–Be proactive. Create a family code word to signal emergencies to each other

–Never wire money without being absolutely sure of the recipient and the reason.

And this goes for you, too, Mom and Dad.

Posted 3/31/11

Tax tips from our consumer watchdogs

March 1, 2011

Tax refunds are among the few things to look forward to when it comes to W-2 season. And in this tough economy, taxpayers may be tempted by promises to speed up the gratification with so-called instant “refund anticipation” loans.

But the Los Angeles County Department of Consumer Affairs has a message for anyone who might be considering such an offer: Don’t.

“You don’t need to do it to get your money quickly,” says Acting Consumer Affairs Director Rigo Reyes. “And people typically end up paying very hefty fees they don’t need to pay.”

Such loans—usually billed by commercial tax preparers as “instant” or “rapid” refunds—typically offer consumers their refund money the moment their tax paperwork is finished. But Reyes says they are among the most common tax season consumer traps.

They’re actually short-term loans with massive interest rates—as high as 300 percent in some cases. They can not only substantially reduce a refund, but leave a taxpayer owing more money if it turns out that the preparer miscalculated the tax obligation. And with electronic filing, taxpayers don’t really need them.

“Yes, years ago, it did used to take a couple of months to get a refund,” says Reyes, “but today, you can ask for an electronic refund and get your money in less than two weeks.”

If you have questions about these loans, or have been taken advantage of and want to file a complaint, call the Department of Consumer Affairs at 800-593-8222 or click here.

By the way, that’s not all the advice the county’s consumer watchdogs have for taxpayers. Here, courtesy of Reyes’ team, are a few other tax-season tips (Spanish-speakers can click here, here and here):

Don’t buy into claims that you can get away without paying your taxes.

“Don’t believe someone who tells you that you don’t have to pay taxes because of some special law or constitutional loophole that only they know about,” Reyes says. The IRS has a list of frivolous anti-tax arguments that have already been tested in court and shot down. (“One year,” says Reyes, “it was a claim that if you were descended from slaves, you didn’t have to pay because the government owed you slave reparations.”) Taxpayers are free to contest their taxes in court, but tax evasion is a serious crime with serious penalties, says Reyes.

Don’t respond to unsolicited emails claiming to be from the IRS.

The IRS doesn’t request personal financial information via email. But phishers do, and then use it to commit identity theft. If you get a suspicious email purporting to be from the IRS, don’t reply, open any attachments or click on any links. Forward it as-is to [email protected] and, for more information, visit their identity protection page.

Vet your tax preparer.

Even if your best friends recommend a person, take the time to check him or her out. California law requires all tax preparers to register with the appropriate licensing agency. If your tax preparer is a lawyer, make sure he or she is legit at the State Bar of California. If you’re going with a certified public accountant, verify their license at the California Board of Accountancy. Any other kind of tax preparer must be bonded to protect clients against fraud and registered as an “enrolled agent” or a registered tax preparer (RTP) through the California Tax Education Council, where you can look up their status on this handy verification page. For enrolled agents, call the IRS office of Professional Responsibility at (313) 234-1280.

Consider doing it yourself this year.

If you don’t want to spend the money on a tax preparer, filing may not be as difficult as you remember. The state and federal government offer lots of free tax-preparation programs, and taxpayers can file their taxes online. The IRS’s Free File lets taxpayers file for free online and get a refund in 10 days. Low-income taxpayers can get free help through the IRS’s Volunteer Income Tax Assistance Program, which offers state and federal tax preparation help in several languages. To find a VITA site in Los Angeles County, call (800) 829-1040 or click here or here. There’s state and federal help for seniors, too, both through the IRS’s Tax Counseling for the Elderly Program and through the American Association of Retired People. For an IRS/Franchise Tax Board senior counseling site in Los Angeles County, call (800) 829-1040 or click here. For an AARP site, call (888) 227-7669 or click here.

405 bridge work causes a stink

405 bridge work causes a stink