Top Story: Economy

We’re back in the black

April 17, 2014

While expressing concerns about the endurance of the rebounding economy, Los Angeles County’s chief executive has unveiled a proposed budget that confronts some of the county’s biggest challenges and controversies, funding more than 1,300 new jobs to tackle everything from healthcare reform to child protection to oversight of deputies in the jails and on the streets.

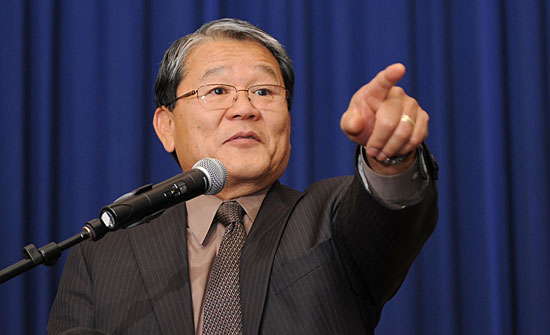

Chief Executive Officer William T Fujioka told the Board of Supervisors on Tuesday that his proposed $26 billion spending plan for fiscal year 2014-2015 represents a cautious expansion of county spending that had been cut by an average of 15% during the Great Recession, beginning in 2008-2009. Fujioka said the driving philosophy behind his proposed budget—balanced for a second consecutive year—is “stabilization” and “sustainability” as county revenues continue to rise with the recovery. (Complete budget details can be seen here.)

Just four years ago, the county had its largest budget gap of the recession—$491 million—and was forced to tap reserves to avoid layoffs and deeper service cutbacks. For five years, employee labor unions agreed to zero salary increases to help the county survive the economic crisis. Now, in the proposed budget, $217 million in “unavoidable cost increases” has been earmarked for raises, benefits and retirement costs negotiated with unions as property and sales tax receipts have moved the county out of the red.

In his budget briefings to the board and the media, Fujioka has emphasized that uncertainties at the federal and state levels could substantially change the county’s budget outlook. Only about $6 billion of the county’s $26 billion budget comes from locally generated revenue, such as property tax, which is forecasted to increase by a little more than 4%. The rest comes from state and federal governments.

If approved in June by the board after public hearings and deliberations, the CEO’s proposed budget would not only reverse some cuts made in recent years (county library hours, for example, would be restored to 2009-2010 levels), but also would underwrite reforms in two departments rocked by controversies.

The budget proposes adding 100 new social worker positions and 26 support staff jobs to the Department of Children and Family Services to reduce caseloads and better protect youngsters who come in contact with the county’s child welfare system.

The move to beef up the social worker ranks through a variety of government funding sources gained momentum after several high-profile deaths of abused children galvanized support for broad reforms. According to Fujioka, additional funds also will likely be made available to underwrite recommendations of the Blue Ribbon Commission on Child Protection, which was created by the Board of Supervisors and is now completing its work.

Fujioka’s budget also calls for spending $36.5 million to implement reforms recommended by another board-created panel—the Citizen’s Commission on Jail Violence, which examined allegations of widespread brutality by Los Angeles County sheriff’s deputies inside the county lockup. This funding, along with $20 million in ongoing resources provided during fiscal year 2013-2014, would pay for more supervisors and more rigorous internal oversight, among other things.

What’s more, funding will be made available for more than two dozen positions in the newly created Inspector General’s Office, a key commission recommendation aimed at bringing more oversight and accountability to the Sheriff’s Department.

Not all the new jobs in the budget, however, are being proposed as a response to scandals. Some are meant to be proactive, “providing a strong foundation as we move forward,” Fujioka said.

More than 700 full-time nursing positions are being proposed to help the Department of Health Services meet state-mandated nurse staffing ratios and compete for low-income patients who, under the federal Affordable Care Act, will receive subsidized health insurance. These patients now will be able to seek care elsewhere. And that means a potential loss of revenue to the county. Thus, Health Services is determined to transform the county from a provider of last resort into a provider of first choice.

Fujioka credited the sound fiscal policies of the Board of Supervisors with allowing county government to ride the economic downturn of recent years with a minimum of disruption, unlike other local governments in Southern California and across the nation.

Said Fujioka: “The board’s long-standing conservative budget practices, and our strong compliance to fiscal policies, enabled us to weather these trying economic times.”

Posted 4/17/14

After a short stall, budget passes

October 9, 2013

The Los Angeles County Board of Supervisors on Tuesday gave final approval to a budget that reflects improving revenues from a rebounding economy, along with urgent new demands on those funds for jail reform, improvements in the child welfare system and other looming needs.

But getting there wasn’t easy. A short-lived—though potentially damaging—budget standoff temporarily stopped the process in its tracks and drew comparisons to the ongoing showdown in Washington D.C. before it was resolved.

It was the first time in memory that the usually routine action of recognizing supplemental revenue in the county budget had been derailed in such a manner, if even for a brief period.

The $362.4 million being transferred in this year’s supplemental budget process was intended to fund a variety of county initiatives—from implementing recommendations by the Citizens’ Commission on Jail Violence to hiring 147 additional children’s social workers to enhancing contract monitoring of foster family agencies and group homes. With property and sales tax revenues on the upswing and an infusion of funds following the state’s disbanding of redevelopment agencies, there was also money for maintenance and capital projects that had been deferred during the lean days of the Great Recession.

Tuesday’s standoff started when Supervisor Mark Ridley-Thomas balked at placing two chunks of the supplemental revenue—totaling $55 million and $20 million—into the county’s extraordinary maintenance and capital project budgets, respectively.

Instead, he argued, the funds should go into the county’s rainy day fund to cover unexpected needs that may crop up. That fund, as of Tuesday, had just over $232 million in it.

Ridley-Thomas’ motion, opposed by Supervisors Don Knabe, Gloria Molina and Zev Yaroslavsky, drew the support of Supervisor Michael D. Antonovich—and that was enough to deprive the supplemental budget item of the 4-vote super-majority needed for passage.

“It’s just like the feds. We have no budget,” Molina said incredulously.

Yaroslavsky said the 11th hour hitch in the budget process was “a Tea Party-esque kind of thing.”

The development came hours into a marathon meeting at which the eventual passage of the supplemental budget—the last step in approving the county’s official spending plan for fiscal 2013-14—had seemed assured. The stalemate was broken a short time later, when Antonovich moved reconsideration of the item.

Antonovich suggested that the two pots of money—the $55 million and $20 million—be combined in the CEO’s budget to address either capital projects or extraordinary maintenance needs in this fiscal year.

That proposal passed unanimously, and the county’s supplemental budget was approved, largely in the same form originally recommended by Chief Executive Officer William T Fujioka.

After the reversal, Yaroslavsky called the whole episode “a bizarre way to do business.”

“It was disconcerting but I suppose one could say, to quote Churchill, ‘Democracy eventually does the right thing, but only after exhausting all the alternatives.’ ”

Posted 10/9/13

Hot home sales fuel record tax roll

July 25, 2013

As home sales boom, at least for now, the county's property tax roll is hitting new heights. Photo/L.A. Times

As Los Angeles’ housing market recovery moves from anemic to heated, county coffers are reaping the benefits of a record-setting, nearly $1.130 trillion property tax roll—more than $50 billion bigger than last year’s.

But thousands of homeowners whose taxes went down when the assessed value of their properties plunged during the recession are catching an upward wave, too. That means higher tax bills for 196,200 property owners, who’ll be forking over an average of $820 more in property taxes this year.

The rise in values isn’t universal: some 121,800 properties that declined in assessed value are staying at the same level this year, while 50,600 properties are experiencing further reductions.

But overall, the trend is positive, with this year’s 4.66% increase in the county tax rolls representing a marked improvement from the 1.49% and 2.24% increases in the previous two years. The upswing reflects a hot market for real estate in many parts of the county, with once dismal home prices rebounding in a big way.

“Strength in the residential real estate market was the largest single factor for the increase in roll value,” Chief Deputy Assessor Santos Kreimann said in a statement.

Assistant Assessor George Renkei added: “In addition to closing the roll at a new record level, we are proud of the accuracy of this year’s forecast as well as the other substantial improvements that were developed and implemented over the past twelve months.”

Even as “SOLD!” increasingly replaces “Bank-owned” or “Foreclosure” on local real estate signs, there are limits on how much a rising market can help the county’s bottom line. Under Prop. 13, property tax increases are tied to the Consumer Price Index and capped at 2%. Most of the time, it’s an uphill progression that allows the county’s tax roll to grow even when individual home prices are in the doldrums. But it’s a testament to how bad things were during the recession that in 2010, the CPI entered negative territory, posing interesting questions for the Assessor’s Office. It had to determine whether, by the law, property assessments would stay level or reflect the CPI’s dip. After consulting with the state Board of Equalization, the assessor granted a .237% reduction to all the eligible properties in the county. Since then, the adjustments have been in positive territory: less than 1% in 2011, 2% in 2012, and 2% again this year.

Property taxes represent a major part of the county’s budget, and the 4.66% increase that pushed the roll to its highest level ever this year translates to an estimated $180 million more in the county’s general fund.

Such increases are welcome news for the county’s budget—but small potatoes compared to the potential infusion that the county will realize when thousands of properties that haven’t changed hands in decades eventually are sold and their values adjusted to current market levels.

Prop. 13 rolled back property assessments to 1975-76 levels until a property is sold, when the new value is allowed to adjust upward. While the vast majority of L.A. properties have changed hands at least once since 1981, 362,710 of them haven’t, representing 19% of the parcels in the county, according to an analysis by the county’s Chief Executive Office. The “stored value” in those properties represents a potential multimillion dollar infusion for the county’s general fund when they’re sold in the years to come.

Posted 7/25/13

No deficit of good news in this budget

April 15, 2013

Chief Executive Officer William T Fujioka says his budget proposal reflects years of fiscal discipline in the county.

Just three years ago, in the thick of the Great Recession, Los Angeles County officials proposed a budget to the Board of Supervisors with a deficit of more than $490 million, prompting an extraordinary belt-tightening that forced some county departments to slash spending by more than 30 percent.

Back then, Chief Executive Officer William T Fujioka put the best spin possible on the gloomy situation. Despite the gaping shortfall, he said, the county had not been forced to significantly reduce services or lay off workers, who’ d agreed to forgo raises until the crisis had passed.

It looks like that day may have come.

On Monday, CEO Fujioka offered a $24.7 billion spending plan for board approval that, for the first time in five years, has no deficit and no proposed cuts. This year, there’ll be no raiding reserves or other one-time funding solutions.

“This is unheard of, not only here within the county but throughout the state of California,” Fujioka said of the county’s proposed zero-deficit budget, which will be financed entirely by ongoing revenue sources. Departmental cutbacks, efficiency initiatives and rising property and sales tax revenues were central to the budget turnaround, Fujioka said. But the county could not have weathered the economic storm, he stressed, without the fiscal discipline of the Board of Supervisors and the cooperation of employee unions.

Unlike City of Los Angeles workers, whose raises have been blamed for the city’s dire finances, county workers haven’t received a cost-of-living raise in five years—a savings of hundreds of millions of dollars that has helped preserve programs and save jobs. The unions agreed to the arrangement so long as the money would begin to flow once the county’s finances were back on track. Union leaders are wasting no time holding the county to its word; Fujioka said his office already has begun negotiating with public safety unions.

Jim Adams of the CEO’s office, who’s been negotiating with the unions for a little more than a month, says he expects there’ll be “some kind of pay increase.” Citing the confidentiality of the talks, he declined to be more specific but cautioned that every 1-percent increase in the county workforce’s payroll amounts to close to $40 million, not including benefits. “We’ll be sweeping the budget corners,” looking for ways to fund raises, he said.

Adams and others said they expect a chunk of that to come from rising property tax revenues, which are likely to exceed the Assessor’s conservative forecast of 2.88 percent for fiscal year 2013-2014.

For the most part, the new spending plan holds the line on departmental budgets that have been pared back during the past five years, recommending only small spending increases or none at all. “We’re not going to quickly and blindly restore people” to departments without a specific need, Fujioka said during a morning news conference. He cited, for example, a reduction in the number of clerical workers in the treasurer’s office to process property tax payments. As a result, the payments took an extra day or two to deposit in the bank, Fujioka said, costing the county “a lot of money” in interest.

The CEO says he is, however, recommending that new funding be used to enact a series of reforms urged last year by the Citizens’ Commission on Jail Violence, which investigated alleged deputy brutality within the county’s lockup. Among other things, Fujioka said he’s proposing that $5 million be set aside each year for the soon-to-be-created Office of the Inspector General, which will oversee and monitor sheriff operations in the jail and on the streets.

Fujioka also cautioned that unforeseen budget pressures could arise from the full implementation next year of the Affordable Care Act, as well as the continuing implementation of a massive transfer of responsibilities from the state to the county for supervision of ex-California prison inmates.

Still, despite such uncertainties, Fujioka’s press briefing had the feel of a victory lap as he praised the leadership shown by the five members of the Board of Supervisors, who’ll begin public hearings on the budget in May.

“You probably think it’s easy for a guy like me to say something like that because they’re the people I work for,” Fujioka said. “But it’s the absolute truth.”

(For a quick-paced video primer on the county budget process, click here.)

Posted 4/15/13

For Hollywood, no splendor in the park

April 5, 2013

The scene at Grand Park, where film executives have complained about high fees. Photo/Shabdro via Flickr

Lucas Rivera had barely gotten his feet wet in Grand Park’s beautifully restored fountain when Hollywood came calling. Sony’s Screen Gems told the park’s newly named director that it wanted to use the Arthur J. Will Memorial Fountain in a scene for an upcoming remake of the romantic comedy “About Last Night.”

But what studio executives say they heard from Rivera last fall was no laughing matter. The price to film in L.A’s hippest new green space was $20,000 for each of the park’s four blocks—the steepest fee for any publicly-owned venue in Los Angeles.

Lucas, who was swamped with planning the park’s gala grand opening at the time, says the request “came at us out of nowhere.” The filmmakers repeatedly insisted on lower rates but Lucas says there was nothing he could do because the fees had been formally set by the county. Already committed to the location, the studio grudgingly paid the $20,000. But that was only the first act of a civic drama that, for months, has pitted county officials against their hometown industry.

Since October, the cost of filming in Grand Park has become a cause célèbre among location scouts, labor leaders and studio representatives, who’ve publicly challenged the county’s commitment to keeping entertainment jobs in the Los Angeles region. Screen Gems is the only studio so far to pay Grand Park’s high price of admission. In interviews and in testimony before the Board of Supervisors, industry officials have argued that the high film fees at Grand Park and such famous county-owned venues as the Hollywood Bowl, Walt Disney Concert Hall and the Los Angeles County Museum of Art are contributing to the long-running exodus of Hollywood jobs to more film-friendly locales in the U.S. and abroad.

“These are iconic Los Angeles County landmarks and we are turned away from filming them due to high fees or rules that seem designed to discourage production companies to even consider approaching them rather than embracing this cornerstone industry that helped create part of the rich history that is Los Angeles,” Teamsters official Ed Duffy, who represents location managers, complained to a receptive Board of Supervisors last October. The board ordered a review of the controversial rates by the Chief Executive Office.

On Tuesday, the board is expected to vote on a new permit structure for Grand Park proposed by the county CEO in the wake of the industry’s complaints. The proposed rates have been slashed by 74%, but the fees are still prohibitively high for a public park, industry representatives insist. The county says its goal is to strike a balance between the economic needs of the entertainment business and the park’s primary purpose as a place “first and foremost for the community to enjoy.”

Rivera understands Screen Gem’s case of sticker shock and acknowledges that the initial rates didn’t achieve the right balance, which he mostly attributes to the park’s growing pains.

“We’re young, we’re going to make some bad choices,” Rivera says. “But this is a learning process. With all the people involved, we’re going to get it right…My main concern has been to program the park and make it a destination place for Angelenos.”

So far, he seems to be succeeding.

The park, with its unique cityscape surroundings and dramatic view of City Hall, has been widely praised for its programs, from noontime yoga sessions to a weekly farmer’s market to a presidential election-night viewing party broadcast live by CNN. The CEO says the park, which is managed by the Music Center, attracted more than 19,000 visitors during its first six months of operation and has established 53 programming partnerships.

Entertainment industry representatives say they fully respect that the county’s No. 1 priority is to make the park a hit with the public.

Philip Sokoloski of Film LA, a nonprofit organization that coordinates and processes film permits, says industry executives “realize the park is for public enjoyment first…They don’t want to displace other activities and uses. They just want to make sure they aren’t priced out of the park.”

Some fee critics, though, even question the county’s rationale, noting that even under the new pricing structure, it would cost $12,000 to rent all four blocks of Grand Park between the overnight hours of 9 p.m. and 9 a.m.

County officials say they based the original and revised rates on those charged by other high-end venues here and across the country, including the Huntington Library in San Marino, a private nonprofit institution that charges $11,000 a day, and the Hollywood Bowl, which costs $17,000 to rent. But industry representatives argue that Grand Park’s pricing should be in line with more comparable county venues, including Descanso Gardens and the Los Angeles County Arboretum and Botanic Garden, which charge daily rates of between $1,500 and $6,400 and are often used for film shoots.

Dawn McDivitt, who oversaw Grand Park’s construction for the CEO’s office and continues to play a key role in its operation, says she hopes the new rates will be approved by the board on Tuesday. She knows that some entertainment industry officials still will be unhappy, but she says the county will evaluate the program in six months. Nobody in the county, she says, is ready to say the issue is a wrap.

“We’ll look at the experience we’ve gained from having filming in the park and its impact on the public we want to serve,” McDivitt says. “It’s all an evolving process.”

Posted 3/21/13

A shoe-in for taxpayers

October 31, 2012

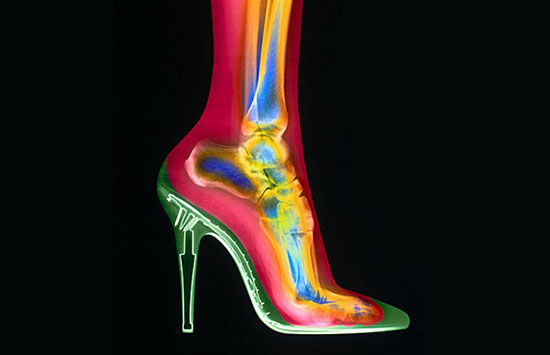

It pays to put your best foot forward. Just ask the folks at the Department of Public Social Services.

Three years ago, DPSS discovered that it was losing nearly a million dollars a year, not to mention thousands of work hours, to slip-and-fall injuries in the workplace.

“We had individuals falling in parking lots, slipping in hallways, falling down the stairs, tripping over frayed carpet,” recalls Sherise McDowell-English, who handles risk management in the department’s human resources division. Mystified, they studied the data and interviewed managers in every bureau.

Finally, she recalls, they pinned down the problem: “People were coming to work in platform high heels and flip-flops.” The result? A Safe Shoe Campaign that last year saved the department more than $1.1 million and cut trip, slip and fall injuries by 23%.

That campaign is just one of more than 20 efforts, large and small, that are being honored this week at the county’s 26th Annual Productivity and Quality Awards. Because of Los Angeles County’s size, even seemingly modest improvements can make a huge difference, with results that go far beyond “attaboys” from bosses.

According to Chief Executive Officer William T Fujioka, award winners have garnered nearly $4 billion for the county in savings, cost avoidance and revenue since their inception a quarter-century ago. William A. Sullivan, who heads the county’s Quality and Productivity Commission, estimates that the county benefitted to the tune of nearly $170 million from the projects being lauded this year.

This year’s honorees (click here for a video sample) range from an iPhone app that allows county residents to request pothole repairs and easily follow their progress to a housing program that leveraged a $115 million county investment into a $551 million pool for the development of supportive housing for the homeless mentally ill. Here’s a look at some of the others:

- An efficiency project in the Registrar-Recorder/County Clerk’s Office that shortened the month-long wait for most certified copies of birth, death and marriage certificates to a week or less.

- A data mining program at the Department of Public Social Services that is expected to save the county tens of millions of dollars by using an algorithm to detect fraud among recipients of subsidized child care.

- Prescription improvements at the Department of Health Services that have helped some 22,000 uninsured patients qualify for free medications from pharmaceutical manufacturers and that have bar-coded medication to avoid lethal mix-ups at county pharmacies.

- Technological improvements that have increased child support collections by $10 million, improved workflow at the Alternate Public Defender’s Office, streamlined water billing at the Department of Public Works, helped the county avoid rehiring sub-par contractors and offered a one-stop jury duty portal to Superior Court jurors.

- Collaborations that have improved medical services for abused children, reduced recidivism among military veterans with substance abuse and mental health problems, saved millions by helping county general relief recipients qualify for federal SSI benefits and diverted homeless people around the Los Angeles County-USC Medical Center to an urgent care clinic for primary care, as opposed to the costlier emergency room.

- A first-in-the-nation clinic for the treatment of chagas, a parasitic disease that is one of the leading causes of heart failure among Latin American immigrants in L.A.

- A plan that vastly improved public access to last year’s redistricting process.

- A special forensics training program for U.S. Marines at the Coroner’s Office.

Several of the awards are for programs that have already been expanded. The project that streamlined the mail processing of vital records at the Registrar-Recorder/County Clerk’s Office, for instance, has already led to improvements in the processing of fictitious business registration, the scanning and recording of property documents and a search for ways to consolidate the office’s call centers, says Sandra Spencer, an elections programs coordinator who worked on the original project.

“Our feedback has been really great,” she adds. “We actually get letters and phone calls from people, thanking us.”

Meanwhile, at DPSS, slip-and-falls are no longer the No. 1 source of injuries. (It’s all about the pushing and pulling of heavy file drawers now, according to human resources workers.)

But McDowell-English says the colorful Safe Shoe fliers and posters will remain, to keep workers on their toes—and balanced. As for her own footwear, she says she sets a cautious example: “I wear ballerina flats to work.”

Posted 10/25/12

County property values inch up

September 11, 2012

It’s the $1.079 trillion question: what’s going on with property values in Los Angeles County?

A new report from the Assessor’s Office says they’ve gone up, modestly, for the second straight year in most of the county.

From the perspective of local governments, this year’s 2.2% net increase in the county’s trillion-dollar-plus property roll means more property tax revenues coming in to support services. It’s a positive sign after several years of major declines threw cold water on what was one of the country’s hottest real estate markets.

The city of Los Angeles, for example, where property values went up 2.5%, stands to receive an additional $110 million or so, said Assessor’s spokesman Louis R. Reyes.

Most municipalities across the county are in the plus column this year, led by Beverly Hills (6.5%), Rolling Hills (6%), Bradbury (5%) and San Marino (4.9%), with Arcadia, Monterey Park, Santa Monica, Manhattan Beach, La Canada Flintridge and South Pasadena rounding out the Top 10.

Only seven areas experienced drops in assessed property values. They are: Bell (-2%), Westlake Village (-2%), Lancaster (-1.2%), Santa Clarita (-0.9%), Hidden Hills (-0.8%), Palmdale (-0.6%) and Carson (-0.1%).

(Read the full report here. Community-by-community listings begin on page 14.)

Despite the uptick in real estate values in most parts of the county, it’s not all good news. Some 406,000 property owners received “decline in value” assessments in 2012, more than the 393,000 reductions in 2011 but fewer than the peak of 426,000 in 2010.

Foreclosures are still high—30,000 in 2011. That’s down considerably from the 41,300 foreclosures in 2008 but sharply up from the 2,000 recorded in 2005.

And median prices for single family homes in the county stand at $305,000, well below the $510,000 median reported in 2006.

Posted 9/10/12

County budget hints at a turnaround

April 17, 2012

The county's new budget shows signs the economy is turning around, as hiring and other indicators pick up.

When is a $75.8 million budget deficit good news?

When it comes after three straight years of far more severe gaps that ranged as high as $491.6 million.

After several years of navigating the most profound recession in recent memory, the proposed 2012-13 county budget unveiled this week suggests that in Los Angeles County, at least, the worst may be over.

The balanced $23.78 billion budget presented to the Board of Supervisors and the public this week “will result in no layoffs, no furloughs, no service cuts and no major reduction in anything that we do,” said County Chief Executive Officer William T Fujioka.

That’s in big contrast to the dire financial plight of many other local governments in California and elsewhere in the country.

“Particularly in a county with so many needs and so many people, it’s very, very impressive,” said Supervisor Gloria Molina.

Board of Supervisors Chairman Zev Yaroslavsky joined his colleagues in praising the county’s financial position relative to others, but cautioned that a lot can happen between now and September, when the final budget will be adopted.

“I do think that we have a lot of uncertainties out there. We got a little taste of one last week when the assessor revised his estimate on property tax revenues by a significant amount,” he said, noting that other issues loom on the state and federal levels, including a Supreme Court ruling on health care reform which could have “serious and significant” consequences here.

Fujioka’s release of the proposed spending plan is just the first step in a lengthy budget process that moves next to public hearings in May.

For now, at least, there is room for cautious optimism about where the economy is heading, Fujioka said, pointing to several encouraging signs.

The caseload for general relief, which the county provides to people with no other means of support, expanded dramatically in recent years as unemployment spiked, but is now decreasing and is expected to be 6.2% smaller in the coming budget year. That’s partly because of program changes moving qualified GR recipients to federal and state assistance, but also indicates that people may be starting to find work, Fujioka said.

“It shows that people are coming off GR, that they’re going back to work, hopefully, and that the economy in general is starting to grow,” Fujioka said.

That’s significant to the budget because funding for GR comes entirely from the county and the projected savings—$27.4 million—can be used to fund other needed programs.

Sales tax revenues also are expected to tick up by 3.4% in the coming year. And state vehicle license fees, which help fund programs in county departments including probation, are rising as well, although not as robustly as Fujioka would like.

“People are buying cheap cars,” he said, jokingly telling reporters who attended his budget unveiling Monday that “I want all your readers and those who are watching on TV to go buy more expensive cars. They can help the county out.”

Property tax revenues appear to be on the upswing, too—but with County Assessor John R. Noguez’s recent downscaling of his projections, the county could be facing an unanticipated $50 million shortfall. A board-ordered audit is underway but whatever its findings, Fujioka said, “I’m confident we can manage this.”

In addition to uncertainty over property tax projections and over upcoming state and federal developments, there’s also the continued issue of the county’s sagging investment earnings, which were $201 million in 2006-07 but are expected to be just $34.7 million in the fiscal year ahead. “That has gone down dramatically,” Fujioka said. “Huge change.”

On the positive side, efficiency initiatives are expected to save the county an estimated $255 million annually. Those include finding pharmaceutical drug savings of more than $100 million a year, getting rid of unused phone lines and installing smart irrigation systems in county parks.

While it has been able to avoid laying off any employees, the county has trimmed its workforce by 2,164 positions over the past five years. Department budgets have been cut by an average of 17%. “Yet you have not seen a 17% cut in the quality or even the manner in how we deliver services,” Fujioka said.

The new budget even calls for some modest hiring, including 157 sheriff’s positions and 56 new hires in the Department of Children and Family Services. And Fujioka said the county will be able to bridge what he termed the “absolutely manageable” budget gap of $75.8 million without dipping into the county’s Economic Reserve and Rainy Day funds.

Fujioka credited the county’s overall budget situation to a stable and fiscally disciplined Board of Supervisors, to county employees who have agreed to go without raises and cost of living adjustments during tough times, and to a willingness to confront budget realities head-on.

“We do not kick the can down the street,” he said. “We deal with our problems today.”

Posted 4/17/12

A measure of good news?

March 29, 2012

L.A. County inspector Mark Smith says 94% of pumps are accurate, with mistakes often favoring consumers.

The price of gas may not be particularly reassuring, but Mark Smith may have some comforting news.

An inspector with the Los Angeles County Bureau of Weights and Measures, Smith is part of a 13-person unit that monitors the county’s 55,000-plus gas pumps. His mission? To make sure beleaguered consumers get what they pay for at the gas pump. His message? Ninety-four percent of the time, they do.

“When the price of gas is real high, like it is now, people ask me about four times a day if the gas pumps are in compliance,” said Smith, pulling up to a bank of pumps at a United Oil station in Santa Clarita on a recent morning. The sun gleamed on the aluminum tanks of his specialized testing truck. Around him, glum-looking motorists stood, filling their tanks and averting their eyes from the gas meters as the dollars flew by.

“This has gotta be wrong!” exclaimed Santiago Cardenas from the next pump as his mid-sized Mazda SUV guzzled gallon after gallon. “I notice the needle is at not more than half the tank and it’s already at $55!”

“When gas prices spike, usually so do consumer complaints,” Smith noted. “People say, ‘I know my tank holds 20 gallons and I just pumped 21,’ or ‘I just put six gallons in a 5-gallon can—I’m being shorted.”

In fact, Smith explained to Cardenas, owners’ manuals and gas gauges are notoriously inexact when it comes to conveying the precise capacity of a gas tank.

“If your owner’s manual says 20 gallons, you can probably put as much as 22 in it, and if your gauge says a half or a quarter of a tank, you could have anything around there. I’ve been on hundreds of complaints like that and they’re almost never valid,” Smith said.

Smith and his colleagues operate as a sort of team of “gas busters” for haunted consumers who often drive away from the pump wishing they knew whom to call for relief. Each year, the team checks each grade of fuel at each pump at each of the county’s 1,900-plus gas stations; inspectors also investigate every complaint received by the department, usually within hours.

“We had, like, a 150 percent increase in complaints earlier this year when the price of gas went way up,” said Laurence Nolan, who heads the bureau. In less stressful times, Nolan said, the bureau averages about 500 complaints annually.

Though an inspection involves scores of issues, from equipment to handicapped signage, the pumps are subjected to a fairly straightforward test: A pickup truck equipped with four 5-gallon measuring devices—one for each of the usual grades of gasoline and one for diesel—is pulled up next to the tank. Then five gallons are pumped into each receptacle to see if the pump’s measurements and the county’s match.

If the reading is off by more than 6 cubic inches, or about 3 ounces, the owner is cited and given 30 days to fix the problem. If the error is in the consumer’s favor, the station can decide whether to let the pump continue operating, but if the consumer is being shorted, the county shuts down the pump until it’s repaired.

Fines range from about $150 to $600 per violation, depending on whether the station owner is a repeat offender, said Nolan. After the test, the gas collected by the inspector is drained back into the station’s underground tanks.

Over the years, scams occasionally have been uncovered. In 1999, for instance, a gas station owner and his brother pleaded guilty to felony conspiracy charges after they were caught outfitting pumps at a dozen Southern California Mepco stations with computer chips that generated fraudulent readings.

And last year, a West Covina gas station owner was charged with false advertising after he repeatedly removed parts of the price numbers from his double-sided price signs, leading motorists to believe he charged less than a neighboring gas station.

But the vast majority of station owners are honest, Smith and Noland said, and the pumps are usually accurate to within a couple of teaspoons per gallon. The most common problems involve meters that either start registering a purchase before the consumer starts pumping, or continue running after the consumer stops pumping—“jump” and “creep”, in gas pump parlance. Both generally stem from faulty hoses and nozzles and are easily fixed, Smith said.

“Only about 6 percent of the pumps we check have to be tagged for being out of compliance,” said Nolan. And, he added, the majority of those violations are either borderline or in the consumer’s favor. At that Santa Clarita gas station, for instance, only one pump out of 38 was off-kilter—and it was dispensing too much gas.

“The owners here are losing about four cents a gallon,” Smith observed, adding that consumers also often believe, inaccurately, that station owners are getting rich from the gas crunch.

“Mostly what I hear from station owners is that they can’t believe they’re still in business, they’re making so little profit,” Smith said. “Especially the mom-and-pops. It’s tough out there.”

Still, every penny matters, and Smith does have some advice for consumers.

“When you authorize the pump, look at it for five seconds before you start pumping. See whether the reading jumps. And when you’re done pumping, before you hang up the nozzle, watch again to see whether it creeps up.

“If it does, tell the attendant, tell them what happened and they should refund your money or reauthorize it so you don’t get charged for it.”

If your concern isn’t satisfactorily handled, or you still feel overcharged, you can contact the bureau toll-free at 800 665 2900 or write them at Los Angeles County Agricultural Commissioner/ Weights & Measures Bureau, 11012 Garfield Ave. , South Gate, CA 90280. Or complete an online complaint form here.

Posted 3/29/12

405 bridge work causes a stink

405 bridge work causes a stink